Limitless Exchange is one of the latest sites to enter the prediction markets industry. It differs from other prediction market sites, such as Polymarket and Kalshi as it is an on-chain prediction market on Base. That means every outcome of an event is represented by a token. Customers then buy and sell these tokens based on their predictions of what will happen. When the event finishes, anyone who has correctly predicted the outcome will receive a payout via the contracts.

This review looks at what types of markets Limitless Exchange offer and what their CLOB model means.

What is Limitless Exchange?

Limitless Exchange is one of the fastest prediction markets on the Base network. Users can trade contracts on the outcomes of different events, like on Kalshi and Polymarket, with a CLOB-style UX. Limitless Exchange brings a different approach to the prediction markets space, mixing intuitive UX with a unique market design.

Limitless Exchange: The CLOB Approach

Although Limitless Exchange operates as a prediction market site, it uses a Central Limit Order Book (CLOB) model, which is different from the traditional AMM-based systems used by the likes of Polymarket. The CLOB model gives traders deeper liquidity and more compact spreads.

Users on Limitless Exchange can currently buy and sell share contracts on ‘yes’ and ‘no’ outcomes for events. The long-term aim for this platform is to have fully permissionless market creation, which would allow users to create their own betting markets with no barriers, which fits into the ‘limitless’ mantra of the platform.

Trades on the Limitless Exchange site are executed through Base, which ensures efficiency, speed and security.

Limitless Exchange Features

Limitless introduces a new way to predict the outcomes of real-world events. Some of the key features on the site include:

CLOB-based prediction markets

The Limitless Exchange interface combines familiar market and limit exchanges with complete transparency and the guarantees found with the on-chain framework.

Rewards Program

There is a rewards program available on the LE site where tight spreads are rewarded with daily USDC payouts, similar to Polymarket. This rewards program is tailored for event markets and is a great incentive for existing customers.

How Limitless Exchange Works

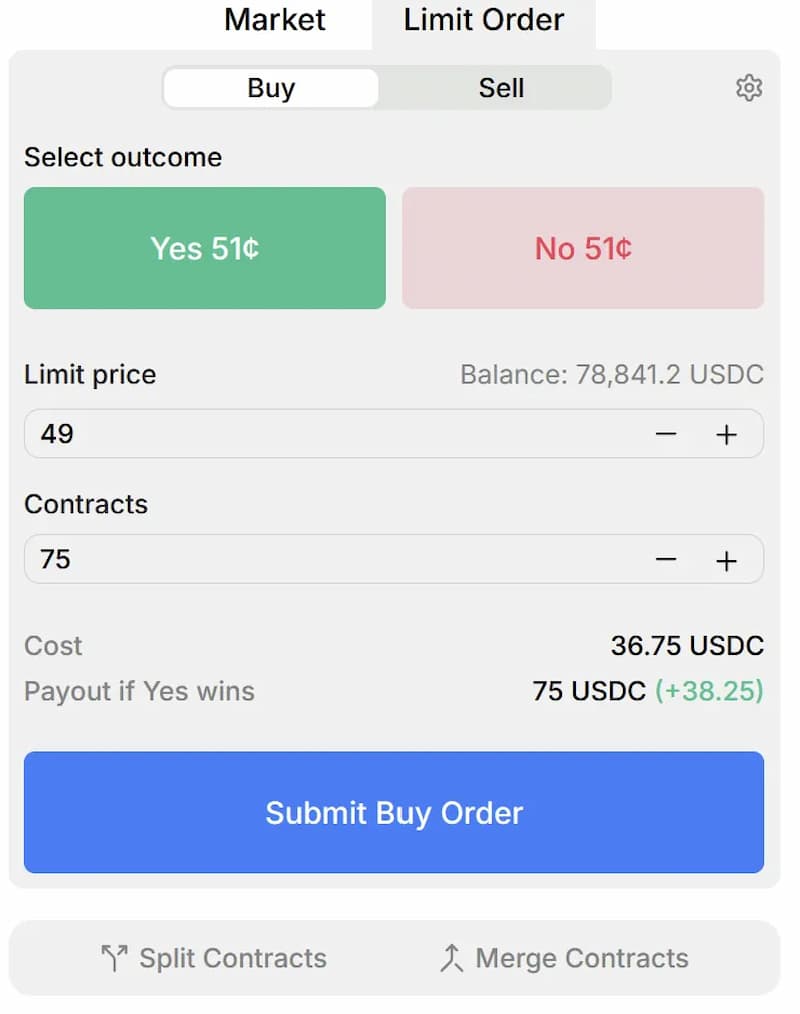

Each market on the Limitless Exchange site has a yes or no order book, with separate bids (buy orders) and asks (sell orders). Placing market and limit orders is how you purchase and sell shares within the order book.

Market Orders

Placing a market order on the Limitless Exchange site is a straightforward process and is perfect if you are looking to pull off a quick trade. All you need to do is choose the number of shares you want to buy or sell, and the system will match your choices to the best prices available. These market orders are a great way to efficiently complete trades quickly, with no fuss.

Limit Orders (Pro Mode)

If you want to have more control and flexibility over your orders, limit orders allow you to set a specific price point at which you are willing to conduct a trade. To place a limit order, you must decide whether you are buying or selling, enter your desired price and the number of shares.

The system will add any orders to your order book, and they will be visible to other traders. Orders that are closer to the existing market price are more likely to be filled. This means that traders can manage the spread and potentially earn LP rewards.

Managing Orders

Managing all of your orders is simple. Head to the market’s order page to view your active orders. If you have changed your mind and want to cancel an order, click the cancel button next to it.

Liquidity

Liquidity is vital for any prediction market, and Limitless Exchange has designed a system to be extremely efficient and appealing to liquidity providers (LPs).

The LP rewards program incentivises people to contribute by earning rewards for providing liquidity. This encourages participation from traders. Unutilized liquidity also does not just sit there inactive. Rather, it can be lent out to traders, which improves capital efficiency.

Additionally, Limitless claims that, unlike AMM systems, where impermanent loss is a risk, its CLOB-based approach mitigates these risks by redistributing yield and strengthening execution costs. Liquidity really dives the Limitless Exchange service.

Our Verdict

Limitless Exchange takes a different approach to more traditional prediction market sites. Its CLOB model and points farming campaign has ensured that it is one of the fastest growing projects on Base. The future success of Limitless will depend it it can attract users away from the bigger names such as Kalshi and Polymarket, and we know from experience that people don’t always like change or a new concept.

We found some of the features on Limitless Exchange quite complex. We like the fact that it has a new, fresh approach to prediction markets, but understandably, there is a learning curve to understand how its notebook works and how you buy and sell shares.

There is no doubt that Limitless Exchange is a disruptor in the prediction markets space, and it will be interesting to see if it can really challenge the likes of Kalshi and Polymarket.